January 2024 Market Update

Marcus Musson, Forest360 Director

Opinion Piece

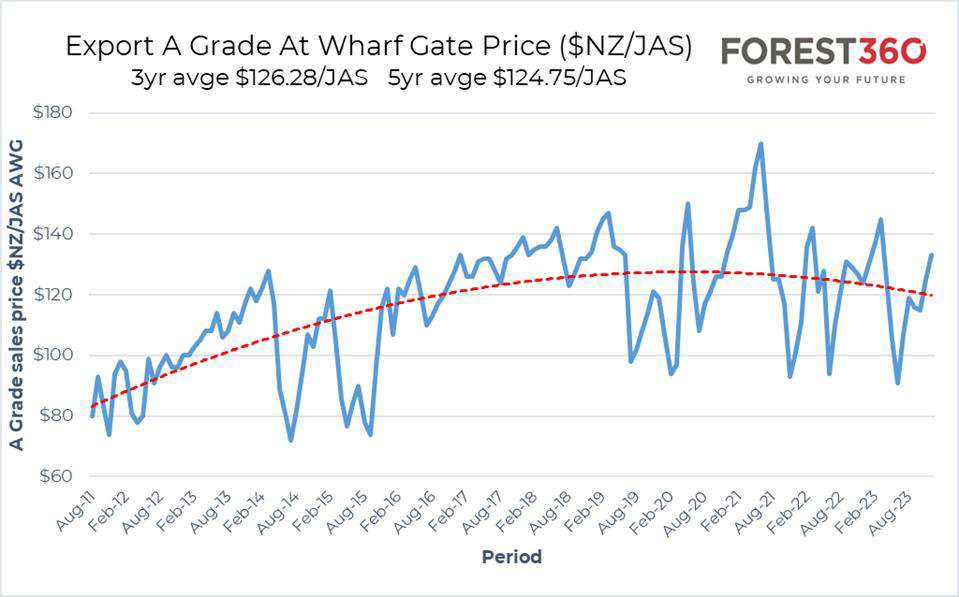

The Christmas holidays have come and gone all too quickly for most and we are now returning to work a few kilos heavier, a touch of liver pain and with the same level of enthusiasm that a lightfingered Green MP has for fronting the media. The few weeks off have enabled most ports to clear stocks as the New Year influx of volume starts to hit the wharves again. January export prices have peeled off a few dollars from December in most cases as shipping and foreign exchange costs increase and erode any increases in actual sales price. Foreign exchange (US:NZ) has increased around 4 cents over the past 10 weeks which does not sound like much but with every cent increase equating to around $3/m3 off the bottom line, it’s rather material.

As for December, the price spread between exporters is around $6/m3 with some in the high $120’s and others in the early $130’s for A grade shorts. Current CFR price (sales price in China in $US) is around $130/m3 which is likely to be the ceiling for a few months with Chinese New Year holidays around the corner. In market inventory has built somewhat to around 2.5Mm3 over the December month, an increase of approximately 30Km3 from November and this is likely to continue to build as Chinese demand falls off a cliff for a few weeks over the holiday period. Demand has been reasonably steady at 70Km3 per day however this has dropped in recent weeks as a very cold snap has kept people away from work.

All eyes will be on shipping costs and the arrivals of vessels from Europe as the Red Sea squabble builds momentum and additional cost of avoiding this route makes European deliveries to China as financially sound as Auckland light rail. Spot container shipping costs soured 173% in early January as Suez Canal traffic decreased 28% and the general inference is that this will likely flow onto bulk vessels, although this may push ship owners to prioritize routes such as NZ:China. The log trade between Australia and China has resumed and there are reports of a number of vessels planned for early 2024.

There is still not much in the way of good news out of China. Reuters recently reported that one of China largest wealth management companies, Zhongzhi Enterprise Group (ZEG) confirmed it was ‘severely insolvent’ and cannot pay its bills. This highlights the issues with China’s shadow banking sector as Reuters describe ZEG as ‘a shadow banking empire’ with liabilities of $460 billion yuan and assets of $200 billion yuan. To top that off, China has lost its prized number one spot as the USA’s top exporter, a position it has held for 17 years. USA imports from China have plummeted from a peak of 21% in 2017 to a shade under 14% in 2023. With around 10 years’ worth of empty housing stock, there is as much chance of a construction lead recovery in China as seeing a blue tie at Jacinda’s wedding.

Domestic demand for lumber products is still strong with many mills experiencing a lift in orders over the past few months. It is unclear whether this is due to increased confidence from a change of government or a restocking of retail supply, but we will take it either way. Pruned log prices are creeping up and supply looks to remain tight in the medium to long term.

Whanganui District Council is the latest in a string of district councils to introduce a target rating system for forestry, to cover the cost of the damage to rural roads (which are generally bereft of regular maintenance) by log trucks. The problem with targeted rates is that the cost has to be carried through the investment and, as sure as Winston likes whiskey, those funds will be used for other purposes and the rural road network will look no different. Any costs compounded throughout an investment either require a higher net return when the investment is realized or if that is not possible, investors will look to other investments that provide a better return on the investment.

The fairest method of rural road funding is a point-of-sale levy whereby the forest pays a per tonne cost as the forest is harvested and the funds go directly to the road maintenance fund of the appropriate district council. This will require a national levy similar to the existing Forest Growers Levy as councils cannot legally introduce levies. It is also important to consider the Road User Charges (RUC) that trucks pay into the government coffers. To put some numbers around this, a truck which has a 50% loaded trip (empty on the return trip) will pay $0.78 per running kilometer in RUC. To take this further, a 200km trip to the port (400km round trip) will cost $312 in RUC or nicely remove $6.24 per log tonne from your net harvest revenue. I hate to think how much of this contributed to the light rail costs.

Carbon prices have softened, with recent fixes in the high $67/NZU range from a high of $75.75 in early December. This is thought to be due to larger emitters having plenty of carbon cover and don’t yet need to start buying from the spot market. This is predicted to change throughout 2024, however, as supply is expected to tighten and the market gains confidence that the government will keep their fingers well away from the policy settings.

So, as we all race back to the gym to fulfill our new year’s resolution of getting in some form of shape, we are quietly content that the market is above the long run average, inventory is low(ish) and the weather is playing ball. Prices will more than likely stay buoyant for February and depending on what unfolds post Chinese New Year it is a reasonable punt that this summer will see some continued good returns. There is still plenty of influencing factors, such as missile throwing which can affect costs, but we will just have to sit tight and see how they play out. Most forest owners are coming to the realization that numbers over $120/m3 are green light territory, and it is unlikely that we will see the giddy highs of previous years. It’s a bit like realizing that round is actually quite a nice shape.