The New Zealand Emissions Trading Scheme (ETS) is New Zealand’s way of meeting our international obligations around climate change. It puts a price on greenhouse gases to provide an incentive to reduce emissions: also to encourage landowners to establish and manage forests in a way that increases carbon storage. The main unit of trade in the ETS is the New Zealand Unit (NZU). One NZU represents one tonne of carbon dioxide.

The ETS is administered by Te Uru Rākau.

There are two types of land as far as the ETS is concerned – Pre 1990 land and Post 1989 land.

A desk-top assessment by the Forest360 Land Use Team will identify Pre 1990 and Post 1989 land on your property.

What is pre-1990 forest land?

Pre-1990 forest is land that was in forest on 31 December 1989 and remained in predominantly exotic forest by 31 December 2007.

Forests on Pre 1990 forest land carry obligations under the ETS, rather than provide opportunities. Pre-1990 or old-growth indigenous forest is not subject to the rules of the ETS.

Post-1989 forest land is land that was established in forest after 31 December 1989. In other words, the land has undergone a conscious use change from ‘nonforest’ to ‘forest land’ on or since 1st January 1990.

| 31 December 1989 | 1 January 1990 |

| Was ‘forest land’ at 31 Dec 1989 and predominantly EXOTIC in 2008 | Became ‘forest land’ from 1 Jan 1990 |

| Can apply for ‘Offset’ to new location | Or change of land use / not forest land for longer than 4 years |

| “Pre – 1990 Obligation” | “Post-1989 Opportunity” |

Any types of trees are eligible for the ETS as long as they are on Post 1989 land and meet the following definitions:

The only exception is orchards/fruit and nut trees, which are ineligible for the ETS.

There are two processes associated with joining the ETS:

Forest360 can assist you with opening an NZETR account and joining the ETS.

Provisional Emissions Returns (PERs)

Owners have the option of submitting Provisional Emissions Returns annually. The returns cover the calendar year, and can be submitted any time between January and June the following year. NZUs accrued during the year will be added to your NZETR account.

Final Emissions Returns (FERs)

Owners must submit a Final Emissions Return covering each five-year ETS compliance period.

The current compliance period runs from January 2023 to December 2025. Your next FER must be submitted between January and June 2026. This is a shorter compliance period than usual, but the 5-yearly periods will resume from 2025.

Contact the Forest360 Land Use Team if you have any queries about emissions returns. It is important to get these submitted correctly and on time.

Selling NZUs can be done on the open market or Forest360 can facilitate the sale for you. If you are thinking about selling NZUs you need to consider whether there are obligations associated with them and how you might manage these. Equally, there may be tax implications associated with a sale, therefore we encourage you to seek advice from your accountant.

Purchasing NZUs can also be done on the open market or Forest360 can facilitate the purchase. Depending on the reason for purchase i.e., as a surrender obligation or as an asset. Again there may be tax and other personal financial implications.

Plantation forestry options include:

Forest360 can advise you on both the economic and environmental implications of the options available to you and work with you to determine a combination of uses which meet your objectives.

Some of the total carbon allocated over the life of a first rotation Post 1989 ETS forest is assumed to stay on-site following harvest, in the form of branches and roots. This is called ‘safe’ or ‘enduring’ carbon and is, in theory, available to the owner without liabilities as long as a harvested forest is replanted.

In practice, the amount of enduring carbon in any forest varies depending on a number of things and the calculations can be quite complex.

Forest360’s Land Use Team can assist you in calculating how much enduring carbon your forest contains.

Sawtooth or stock change carbon accounting was the only way to account for changes to carbon stock in your forest before 2019. This carbon accounting category for the ETS was only available until 31 December 2022 and all forests registered before 2019 use this accounting method.

Under sawtooth, carbon is allocated each year that the forest is growing and sequestering carbon and carbon losses which occur at the time of harvest must be taken into account. At the time of harvest, the proportion of NZUs that reflect the above ground biomass of the forest are surrendered and the NZUs that reflect the residual carbon remain.

The residual carbon from the first rotation will continue to decay at a constant rate for ten years and is calculated and surrendered over this time. If a second rotation is planted and begins to grow it begins to earn units, balancing out the negative change from the decay, and carbon accrual starts again.

The carbon removed (liabilities) is repaid to the Crown via deduction of NZUs from the owner’s NZETR account. Owners with insufficient NZUs to repay their liabilities will need to buy more to meet their commitments.

In June 2020 the New Zealand Government passed legislation which sought to improve the Emissions Trading Scheme (ETS). These changes were designed to simplify the ETS by removing some of the administrative burdens and reducing surrender liabilities.

The main changes which came into effect on 1 January 2023 for forestry participants is the method of carbon allocation. There are two new carbon accounting categories for forests registered after this date:

If you already own a forest which was registered before 2019, or you purchase a forest which was registered before 2019 this will remain under sawtooth (or stock change).

If you purchase a forest which was registered between 2019 & 2023, this could be registered in any of the carbon accounting methods, so it may pay to investigate this further.

Averaging relates to the average volume of carbon that would be stored in a forest over multiple rotations. The assumption is that, as a forest is grown and harvested, total carbon fluctuates but there is an ‘average’ volume of carbon that would be stored in the forest. This will remove the ups and downs (allocations and surrenders) of carbon credits for a forest owner involved in timber production.

Under averaging, a forest will be allocated carbon up to the ‘average’ level in the first rotation (for Pinus Radiata this typically occurs around age 16), no carbon will be surrendered at harvest provided the.

Key conditions around averaging include:

The amount of enduring ‘or’ safe carbon allocated will be calculated based on the anticipated rotation length of the first rotation of forest.

Permanent forestry refers to forests which are entered into the ETS with a commitment from the forest owner to grow these forests for a minimum of 50 years. This category allows selective harvesting, provided that canopy cover of 30% is maintained.

Carbon allocation for this category uses the sawtooth/stock change accounting method, receiving the full allocation of NZUs as the forest grows.

This new category supersedes the old Permanent Forests Sink Initiative (PFSI). Forest owners already with PFSI forests has the option to transition to this new category before the end of 2023. If you did not make a choice on whether to move your PSFI forest by this time, it was automatically moved to this new category.

There is an opportunity within the current ETS around land reverting to indigenous species. There is also potential for landowners who are considering establishing new native plantations to benefit from the ETS.

When combined with potential revenues such as honey or managed grazing retirement, indigenous forests could appeal to many owners of less productive hill country with a passion for returning land to its original forest state. The new Permanent Forests category could also be attractive.

The important qualifier is that the land must be Post 1989 land. Old indigenous areas (which have been there since before 1990) are not eligible for the ETS.

Anyone with large areas of reverting land or new native plantations can contact us for a full analysis of the ETS potential of this land.

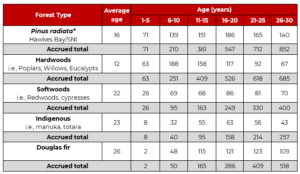

The following table takes data from the look-up tables for Hawkes Bay/Southern North Island region and shows the carbon you could earn under sawtooth or permanent carbon accounting. This shows the total number of NZUs accrued for each forest type.

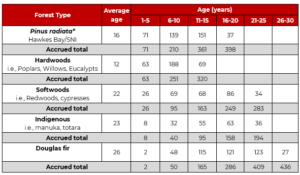

The following table takes data from the look-up tables for Hawkes Bay/Southern North Island region and shows the carbon you could earn under averaging accounting for each forest type.

Participants can choose to file a Provisional Emissions Return (PER) at the end of each calendar year, but must file a Final Emissions Return (FER) at the end of each 5-year ETS compliance period. The current compliance period runs from 2023 to 2025. This is a shorter compliance period than usual, but the 5-yearly periods will resume from 2025.

Forests over 100 hectares are obliged to use the Field Measurement Approach.

ETS participants with over 100 hectares in any one registration must use the Field Measurement Approach.

The Field Measurement Approach involves a forest inventory team establishing a network of plots across the registered forest land. The data collected is used by Te Uru Rākau to create Participant-Specific Tables which are then used to calculate tree growth and hence carbon accumulated.

FMA inventory must be done once in every 5-year compliance period, towards the end of the period.