October 2023 Market Update

Marcus Musson, Forest360 Director

Opinion Piece

Kiwibuild may be the best thing we can export to fix the housing crisis in China, lots of hui but not much doey. Since the early 2000’s, China has been flat-out doeying in the residential construction sector with an unfettered, mass urbanization plan that has seen a massive expansion in apartments throughout the country. During the US lead Global Financial Crisis (GFC), China propped up its economy through local government investment in infrastructure which saw Chinese construction companies such as Evergrande, Country Garden, Fantasia and Modern Land grow quickly. Following their ‘success’, many ‘diversified’ into other investments such as electric cars, energy and higher risk investments fueled by eye watering levels of domestic and foreign debt. The Bank of America Research team estimate that Chinas outstanding mortgages now amount to 31% of GDP and around 60% of all household assets are in real estate.

Que 2021 and a number of these companies started having a few liquidity issues following Beijing’s introduction of the ‘three red lines’ rule after a realization of over speculation in the residential property market. Unfortunately, this might have been a bit like the current government’s ‘Tough on crime’ policy – too little too late. He Keng, the former deputy head of the statistics bureau has said that, at the extreme, there could now be enough empty homes to house 3 billion people, but more likely, there’s enough to easily house 1.4 billion, which co-incidentally matches the entire population of China. In hindsight, they should have had a bit more hui before all the doey and, unless the entire population wants to move into a new house tomorrow, new builds might stay subdued for a while.

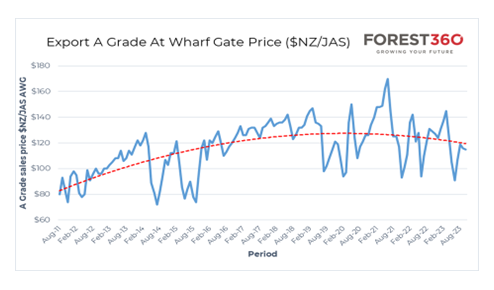

What does this mean for us? Exports to China make up around half of our total NZ harvest level and the majority of what we send there goes into single use construction so it’s a reasonably important market. The old adage that ‘when China sneezes, we get the flu’ comes to mind and unfortunately at the moment the Chinese economy has a really good dose of pneumonia. There is still underlying demand from China at the level of around 60,000m3 per day, which is around 2,000 truck and trailer loads, but it’s an unknown what that will look like going forward. October at wharf gate prices are down around $5/m3 on September to the $114/m3 level (A grade) which is $12/m3 lower than the 3 year rolling average and $14/m3 under this time last year. With current cost structures for harvesting and cartage, anything under the 3-year average is a bit marginal.

There was some good news with fuel prices heading south over the past few weeks but following Hamas and Israel throwing explosives at each other in the past few days, West Texas Crude has shot back up $4/barrel overnight and, as sure as God made little kittens, prices will keep heading up as long as the conflict continues. Shipping prices had a rally in late September but have since stabilized in the early to mid $US30’s/m3, however, the increased fuel prices will likely see pressure on this.

The government obviously thought that recent instability in the NZ carbon market caused by their fiddling wasn’t enough as MPI recently announced its Tranche 2 cost recovery for ETS participants which will see an increase in annual charges of several thousand percent. New charges will see ETS participants now pay $30.25 per hectare for the pleasure of sequestering carbon. MPI have stated that their annual costs for managing the NZ ETS scheme add up to around $29.8M and are seeking to recover $18.9M of this from participants. This is a massive increase in cost for forest owners and will put a big dent in the collective ability to achieve our 2050 climate change commitments. This will especially derail the Climate Change Commissions’ target of establishing a further 300,000ha of native forest as native’s have a much lower carbon sequestration and any increase in costs will make investments in native conversion or establishment uneconomic.

In response, a number of prominent industry groups have joined forces to fight the good fight and seek a judicial review into the imposition of the new MPI fee structure. The group includes The Climate Forestry Association, NZ Institute of Forestry (NZIF), The National Māori Forestry Association, Forest Owners Association (FOA) and a number of other forestry representatives and interest groups representing more than 300,000ha of forests nationwide. FOA CEO, Dr Elizabeth Heeg summed the situation up well in a media release by stating “The system should be designed so that polluters pay, rather than penalising the people who are doing the vital work of capturing carbon dioxide. Ultimately all of us as taxpayers will be forced to bear the cost of New Zealand’s failure to meet its climate targets. We are already projected to fall short of the target and the uncertainty created by measures like this just makes for a bigger bill.” James Treadwell, president of NZIF expects the charges to reduce land values by at least $500/ha. It’s important to remember that this isn’t just ETS eligible forest value, this also extends to farm values – good if you’re buying, bad if you’re selling.

The domestic market continues to see pruned log demand outstripping supply in some regions and pruned log prices are increasing incrementally in response. Sawlog demand is static and the importance of the domestic market to our industry when the export chips are down is more evident than ever. The Pan Pac sawmill in Napier is due to start up again in November following the Gabrielle flooding which is very welcome news to the local community and wider industry.

We’re coming into the traditional Chinese construction season but it’s very unlikely we’ll see a significant increase in demand. NZ supply continues to be higher than it should be at current price levels courtesy of the salvage of the wind damage in Taupo – which has a limited life. We don’t have any antibiotics for the Chinese economy at this point and will have to wait and see what eventuates in terms of further stimulus from Beijing. Hopefully, post-election we will see an improvement in the NZ hui:doey ratio, softening interest rates and a return to a strong NZ construction industry through government led wood first policies……..oh, and a reality check from MPI.