June 2024 Market Update

Marcus Musson, Forest360 Director

Opinion Piece

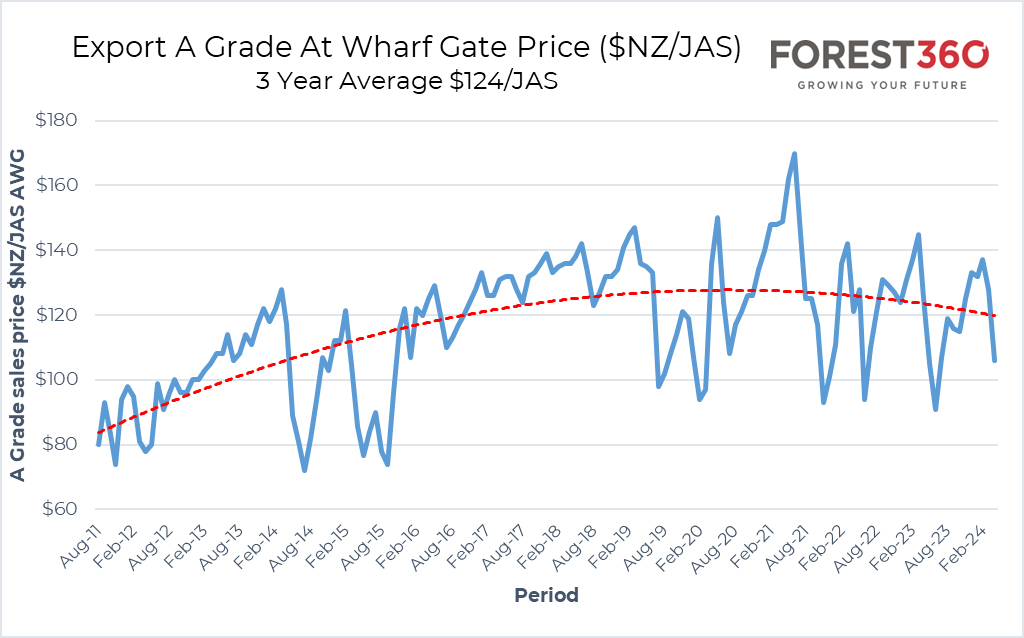

Brace yourself folks, we’re entering new territory. June export prices have come out with only a very slight rise on May, which was only a very slight rise on April, so basically flat at the bottom of the cycle. This is the first time in the last 15 years that we haven’t seen a price bounce once the bottom of the market is hit. Sure, there have been instances where it was a dead cat bounce which resulted in a double dip, but this time Fluffy’s stayed flat on the deck. Fortunately, the bottom of this cycle (which it hopefully is) is around $15/m3 higher than any of the dips in the last 8 years but, nevertheless, it’s still painful.

There has been positive movement in the CFR price (sales price in China) with a lift of around $US10/m3 over the past three months but increases in shipping and FOREX have taken the fun out of the party. Chinese on-port inventory has moved lower in June and currently sits around the 3.4Mm3 mark, down 600K/m3 from May. Uplift from ports is running at around 70K/m3 per day, although this is expected to drop as China enters its hot season and some of the workforce return to home to harvest crops during June. In addition, construction sites must cease work for a few days in early June during the high school exams to reduce noise pollution – imagine trying that in NZ!

As expected, the NZ supply is starting to wind back as the Taupo windthrow salvage finishes and what’s left of the woodlot sector slows as the rains start. There are still some older cargos in China that will need to be worked through, but with reduced supply we would expect to see inventories continue on a downward trajectory. It may not be heading down as fast as Synlait’s share price, but any movement is good for potential price increases.

There has been some good news on the Chinese construction front with the Government putting their ‘Three Major Projects’ development plan into action. This plan includes construction of affordable housing, renovation of urban villages and construction of recreational facilities that can be converted into emergency hospitals or accommodation. Reports out of China are that some of the more run-down neighbourhoods have commenced redevelopment and some of the larger infrastructure projects have started, thanks to a $US50bn injection from the Pledged Supplemental Lending program by the Peoples Bank of China. However, let’s not get too carried away with the Moet, the level of this program will be a drop in the bucket compared to the debt fueled construction addiction that the country had for the past 16 years.

NZ will see three vessels’ head to India in June and there is the potential that demand may increase somewhat in that market. It’s still only early days with supply back into India, and volumes are pale in comparison with China’s monthly tally of 40 odd vessels, but from a supply perspective, anything that’s not heading to China will have a positive effect in the long term.

Domestic sawmills continue to wade through a softening market with NZ residential construction spending reducing from 6.1 billion to 5.3 billion over the past three quarters. This softness is likely to continue as long as our esteemed Reserve Bank Governor keeps the OCR in top gear, and it doesn’t look like the clutch will start slipping until we’re well into 2025. Domestic pruned log supply remains higher than expected as export pruned prices stay subdued and sales that would normally go over the wharf are diverted into the domestic market. This trend will turn quickly once export prices regain some momentum.

The NZU price is trading at $51/tonne as at the time of writing, down from $56 a few days ago but up from a low of $45 in May. There is still some uncertainty on the NZ Government’s position on forestry in the ETS after the Parliamentary Commissioner for the Environment released a report in late May calling for a phasing down of forestry as a carbon offset over time. What is clear is that as long as there is speculation in the carbon market, NZU prices will continue to swing like a screen door in the wind with changing sentiment.

Thankfully, the new government has seen sense and repealed the ‘Log Traders and Advisors’ legislation which was dumped on the industry by the previous government. This flawed piece of legislation placed more compliance and regulation on an industry already drowning in compliance and regulation and the vast majority of us are pleased to see it flushed down the porcelain.

So, taking a leaf out of the Otis Clay song book, the only way is up – unless you’re a Synlait investor. We hope to see some meaningful price increases in Q3 but, from a macro-economic perspective, it’s unlikely we’ll see prices sustained at the levels we reveled in during the golden period between 2017 – 2019. If you’re sitting on the fence waiting for those days to come again, I hope you have strong undies.